28 Jan How to determine the regulated WACC in European telecoms?

What is WACC?

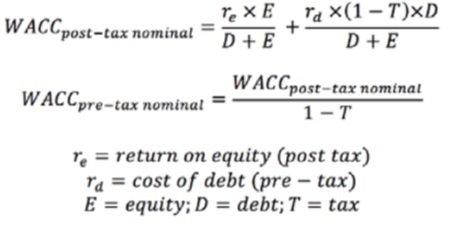

The Weighted Average Cost of Capital (WACC) is a financial analysis tool used to compare a firm’s investments with the cost of the capital raised by the firm to finance these investments. A core concept of the Capital Asset Pricing Model, WACC is used to provide a benchmark against which new investment can be considered. WACC is determined by a firm’s return on equity and the cost of its debt, pondered by the proportions of these two sources of financing. WACC is affected by the tax rate on corporate profits and by inflation.

WACC_real = (1+Wacc_nominal)/(1+Inflation rate)-1

Figure 1: WACC mathematical definition

What is a regulated WACC? What are the impacts of a high or low regulated WACC?

The economic regulation of electronic communications is now focussed on wholesale products. WACC is used by regulators in order to set the price of capital-intensive wholesale products, e.g. duct rental, unbundled local loop, wholesale broadband access or voice termination rates. Regulated WACC levels have a profound impact on buyers and sellers of wholesale products:

- Since wholesale access products are more capital intensive than the activity of buyers of such products, net buyers of wholesale products prefer a lower WACC, net sellers a higher one.

- Those investing in fibre prefer a higher WACC, because the regulated price of their wholesale offering can be higher.

How have regulated WACCs evolved in European telecoms?

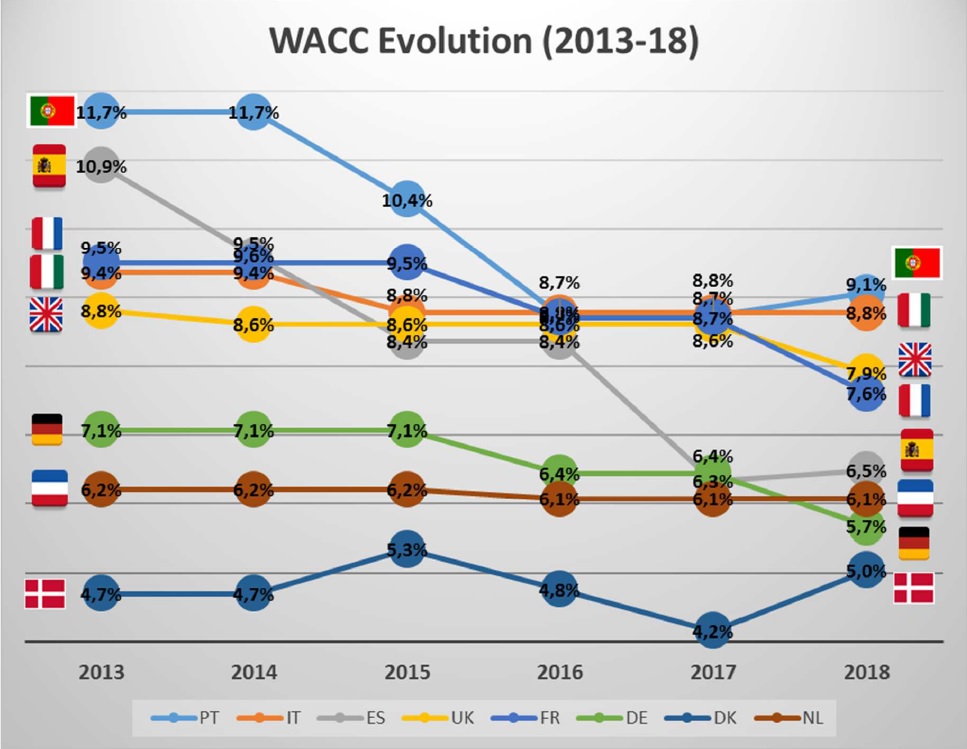

As figure 2 below shows it, the last six years have led to a significant convergence of regulated WACC rates across Europe. Southern Europe, where WACC rates were between 9% and 12% in 2013, now has them between 6% and 9%. Northern Europe, on the contrary, has known much more stable WACC rates, either at a medium-high level (the UK between 88% and 7.9%) or at much lower levels (Germany, the Netherlands, Denmark). This tends to show that the risk-free rate is the single most important factor in regulated WACC determination.

Figure 2: WACC levels in European telecoms

Source: Telefonica’s answer to EC WACC public consultation (2018)

Examples of concrete issues in setting a regulated WACC

- Should the risk-free rate in a given country be based on the rate of National government bonds (as most countries do) or of German bonds (as Ireland does) or on a mix of both (as do the Netherlands)?

- Should there be a correction of the risk-free-rate to account for the non-normal level of interest rates due to quantitative easing policies of the ECB (as Belgium does)?

- How to compare assets that can last 40 or 50 years (such as fibre) with 10-year bonds (the only ubiquitous long-term maturation)?

- Should operators be regulated with one single WACC for all their telecom activities (the choice of ARCEP, the wish of Telefonica) or should a WACC be determined for each regulated activity (the choice of Ofcom and BNetzA)?

European Commission approach to regulated WACC

The Commission services’ preliminary assessment suggests that a common methodology for the calculation of the WACC could be based on four regulatory principles:

- consistency in the methodology used to determine the parameters in the WACC formula;

- regulatory predictability to discourage artificial variations in the methodology used by NRAs and in the value of the parameters over time;

- the promotion of efficient investment and innovation in new and enhanced infrastructures, taking appropriate account of the risk incurred by the investing undertakings; and

- transparency to the industry as to the method that will be used by the Commission and NRAs to determine the reasonable rate of return on their investments, while avoiding unnecessary complexity.

The Commission services’ initial working hypothesis is that:

- A common EU value should be used to estimate the Risk-Free Rate (RFR) and the Equity Risk Premium (ERP); and

- The value of the equity beta, gearing and cost of debt should be based mainly on the national SMP operator but subject to the estimated value being within a range of values for peer EU electronic communications companies (estimated using a common methodology).

BEREC approach to regulated WACC

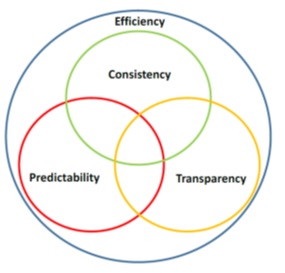

As figure 3 shows it, BEREC, the Body of European Regulators of Electronic Communications, has taken the pragmatic view of putting the pursuit of efficient investment as the encompassing principle of a common WACC methodology.

Figure 3: BEREC’s weighting of the EC’s four regulatory principles for a common WACC methodology

On the risk-free rate, BEREC prefers to track domestic risk-free bonds where the Commission proposes to use a common rate. BEREC and the Commission agree that the Equity Risk Premium should be based on a broad set of historical data, such as those collected by three professors from the London Business School, Elroy Dimson, Paul Marsh and Mike Staunton over 118 years and 21 countries. However, BEREC and the Commission differ in the detail on how these data should be used.

Main players’ positions on regulated WACC harmonisation

The recent publication by the European Commission of the responses to its public consultation on a common methodology for the regulated WACC give an interesting view on how the electronic communications industry is considering the European Commission’s proposals. Incumbents, alternative operators and the industry take the Commission’s proposals quite differently. Deutsche Telekom, an advocate of regulatory holidays for investments in fibre networks, wrote that “WACC Guidelines would send a negative signal to European telecoms investors”. Similarly, Orange thinks that “there is no ground for such a general intervention. If specific problems occur, the Commission can intervene on a case by case basis”. On the contrary, Telefonica, having suffered from a sharp drop of their regulated WACC, believes “that it is necessary to homogenise the methodology in the WACC calculation to avoid the inconsistencies due to the different approach taken by NRAs across Europe to perform the WACC calculations.” This view is shared by FttH Council Europe, which represents the fibre value chain. ECTA, the trade association of European alternative operators, comes to the support of National regulators: “ECTA would be concerned if EC guidance on the methodology for estimating the WACC parameters, other than the RFR, inhibited NRAs’ ability to apply country-specific factors”.

Orange proposes to add five principles (objectivity, flexibility, proportionality, judgement and stability) to the four proposed by the Commission.

FttH Council Europe says that present long-term government bond rates are abnormally low, which drags down the risk-free rate and thus the WACC, lowering the incentive towards fibre deployment. In a subtler way, FttH Council Europe adds that “The greatest omissions concern regulatory commitment and also demand uncertainty leading to option values”. On regulatory commitment, it adds: “the calculation of an appropriate premium is only one part of the equation – credible commitment to sticking with this premium in the face of pressure from competitors and customers is another, even more important aspect”. On demand uncertainty, FttH Council Europe is asking the Commission to consider “the option value that an investor gives up as a result of committing resources – i.e. the value of delaying investments until some of the uncertainty over future returns has been resolved. The value of this option is commonly reflected in firms using hurdle rates that are well in excess of their cost of capital, and regulated returns that should promote investments have to take account of this. Expecting to be able to earn a regulated return that covers a firm’s WACC is insufficient to trigger investment that is sunk and where returns are uncertain.” In other terms, fibre suppliers think that investing in fibre is risky and that fibre prices should not be regulated.

Is this true? The fear of being betrayed by the regulator does exist among operator CEOs, especially when they do not have the culture of a successful regulated industry. Hurdle rates above WACC are the norm in non-regulated industries. However, wherever there are only one FttH network (in less dense areas) or two of them (in denser areas), investing in FttH at a regulated WACC should be considered a relatively safe bet.

What next?

The guidelines of the European Commission on an EU methodology for the determination of Weighted Average Cost of Capital (WACC) in telecoms regulation are expected in the first half of 2019.