05 Feb Coriolis, a virtual operator, will have access to an activated fibre offer from Orange in Brittany, if no Orange competitor proposes such an offer by April 2019

January 29, 2019: ARCEP publishes a dispute settlement between Coriolis and Mégalis / THD Bretagne

One of the roles of ARCEP, regulator of telecoms in France, is to settle disputes between operators in France, relating to wholesale access and interconnection. Dispute settlement is considered a court of first instance decision. The European Access Directive specifies that the regulator must, once seized, make its decision on the merits within four months. Unlike the UK, German or Dutch regulators, ARCEP’s dispute resolution decisions are very few in number and highly respected.

On January 29, 2019, ARCEP published the non-confidential version of the settlement, made on December 11, 2018, of a dispute between Coriolis on the one hand and Mégalis / THD Bretagne on the other. This regulation requires Mégalis and THD Bretagne to make an activated wholesale offer for access to FttH fibre in Brittany within four months, that is to say before 11 April 2019, under tariff conditions defined in 2015 by ARCEP guidelines, provided that no Orange competitor on the FttH wholesale market in Brittany has published such an offer.

Coriolis, a mobile and fixed virtual operator

Coriolis is the result of the activities of a marketing company of mobile services. Having become independent from Vodafone in 1999, Coriolis has developed a virtual mobile operator activity since 2006, that is to say that Coriolis implements its own mobile switches, while leasing radio access to Orange, SFR or Bouygues Telecom. In 2012, Coriolis reacts to Iliad’s entry into the mobile market by becoming a DSL fixed access reseller and, in 2015, FttH access. Coriolis serves both residential and business customers.

Mégalis and THD Bretagne: project manager and prime contractor of the Very High Speed deployment and operation in Brittany

The local authorities of Bretagne competent in telecom have been grouped since 1998 in the syndicate Mégalis, first to ensure the coverage of Brittany broadband DSL, then, from 2015, to develop access FttH in the whole region, outside major cities.

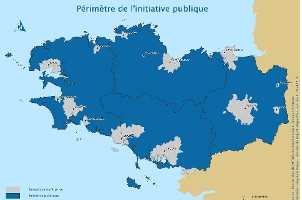

Figure 1: the territory Mégalis promises to serve fibre to the subscriber (source : Mégalis)

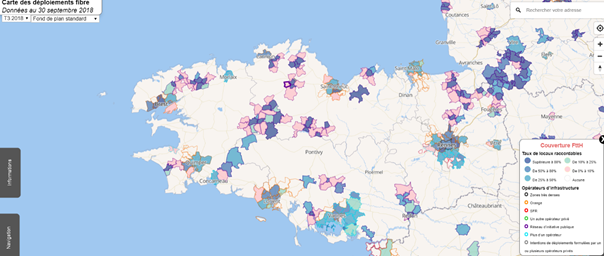

For fibre, Mégalis Bretagne turned to France Telecom, which became Orange. After the 300 million euros of the DSL project, it is a total budget of 2 billion euros that Mégalis intends to mobilize by 2030, the date of completion of the deployment of the FtH in Brittany. By 2018, fibre was available to 70,000 residential or business premises (see Figure 2), adding 170,000 additional accesses in 2020, 400,000 in 2023 and 600,000 additional FttH accesses in 2030.

Figure 2: FttH deployments in Brittany as of September 30, 2018 (source: ARCEP)

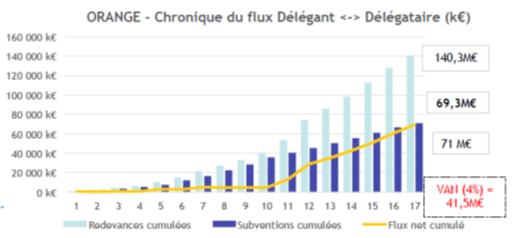

THD Bretagne will pay a leasing fee to Mégalis. According to the assumptions, the net flow received by Mégalis (undiscounted, excluding deduction of the public subsidy for connection of an amount of € 71 million) is € 140.3 million over the seventeen years of the public service delegation. . A return to better fortunes is scheduled on performance beyond the forecasts of the business plan. Figure 3 below reflects the cumulated financial flow in favour of Mégalis Bretagne (represented by the yellow curve) and specifies the net present value at the rate of 4% of this flow.

Figure 3: Royalties paid to Mégalis and subsidies to THD Bretagne (source: AVICCA)

Reminder of the main lines of fibre regulation in France

The regulation of fibre in France distinguishes three zones:

- The very dense zone (ZTD), the heart of the agglomeration of the 120 most dense municipalities of France, in which is shared only the internal wiring to the buildings of more than 12 housing and the sleeves in which the operators spend their optical cables under the streets,

- The area of call for investment intentions (zone AMII), in which there is only one network, of private financing, the cost of which is shared between the operators according to a logic of co-investment ;

- The area of public initiative networks (RIP zone), in which there would be no deployment of fibre without subsidies to operators.

The Brittany region, outside of its main agglomerations, is part of the RIP zone.

Public Initiative Networks: belonging to integrated operators or specialized in wholesale offers

Because of the public subsidy they receive, the public initiative networks are, as soon as they are built, the property of the delegating local authority (here, from Mégalis). The community delegates the construction and operation of the network during the 15 to 30 years of the delegation.

That said, FttH fibre public service entrants belong to two different business families with different profiles and strategies:

- The Orange and SFR companies, when they are public service delegates of FttH fibre, do not forget that they are also integrated fixed and mobile operators in the retail market. Thus, they tend to only offer wholesale passive access offers. Each customer operator to obtain a collection network between their regional point of presence and the optical distribution nodes.

- On the contrary, the other public service delegates (Altitude Infrastructure, Axione, Covage, TDF, to name only the best known) are companies that only serve the wholesale market, and are much more willing to offer offers they are big, because they have nothing to lose on the retail market.

As a result, Coriolis, which is able to buy fibre-activated wholesale offers for second-class RIP delegates, was opposed by Orange, the parent company of THD Bretagne, make him an activated wholesale offer, deliverable in only one point on the national territory.

By refusing, THD Bretagne sought to reproduce in the RIP zone the logic of barrier to entry that is the rule in the AMII zone. In fact, co-investment is open only to operators who build or rent their collection network (from the regional point of presence to the optical distribution nodes) and who purchase a usage right for a minimum of 5% taken from the area served.

Government caught between ARCEP and the Senate

The main provision relied on by ARCEP in its dispute settlement of 11 December was introduced in the ELAN law published in the Journal Officiel of 24 November 2018. This addition to Article L. 1425-1 of the General Code Territorial Communities, introduced at the request of the senator, from The Republicans party, of the Ain département, Mr. Pierre Chaize, against the opinion of the government, states: “” VII.- When a line of electronic communications with very high speed optical fibre allowing to serve an end user is established or operated pursuant to this Article, that it has benefited from public subsidies under the conditions set out in point IV, and that no operator markets activated access to that line, the operator exploiting that line shall grant reasonable requests for activated access to that line and the means associated with it by operators, with a view to providing communications services to this end-user.

“Access is the subject of an agreement between the persons concerned. This determines the technical and financial conditions of access. It is communicated to the Regulatory Authority for Electronic Communications and Posts at its request.

“Disputes relating to the conclusion or execution of the agreement provided for in this VII shall be submitted to the Regulatory Authority for Electronic Communications and Posts in accordance with Article L. 36-8 of the Post and Electronic Communications Code. “

This provision, which favours virtual operators or commercial operators, takes up an idea that ARCEP had slipped in December 2015 in its guidelines on the pricing of wholesale broadband offers: “In order to ensure the proportionality of the measure the RIPs must therefore provide, in agreement with the local authorities, a catalogue of offers to guarantee the effectiveness of wholesale access for operators and the strengthening of competition. Where appropriate, they may be able to offer larger wholesale offer catalogues than private-initiative operators, if necessary by offering, for example, activated access offers “.

A narrow path for ARCEP between the promotion of competition and the promotion of investment

However, ARCEP is aware of the disruption in the behaviour of investor operators introduced by its decision of 11 December. If the conditions for leasing an activated wholesale offer to the unit are too favourable, why would SFR, Bouygues Telecom and Iliad rent fibre optic links from their regional point of presence to Orange’s optical distribution nodes? so burdened with fixed costs over a long period? This is why ARCEP adds to the obligation for THD Bretagne to offer Coriolis activated access a restrictive condition: that no other operator offers a comparable offer in the territory served by THD Bretagne.

Questions still open

The regulation of telecoms is an eternal chess game. Each decision is heard to previous ones to contribute to define the rules of the game which will weigh on the future behaviour of each actor. Finally, let’s take a look at the questions left open by ARCEP’s recent dispute resolution decision.

What price can Orange offer to Coriolis?

There are two ways to approach this issue: following the December 2015 guidelines could give a wholesale price of € 17.70 per month. But the example provided by the RIPs spontaneously offering activated wholesale offers could lead to a slightly higher price (from 19 to 22 € HT per access and per month). That said, the devil is in the detail. Orange is quite capable of adding minimum volume clauses to ensure a good price. It is likely that ARCEP will have to look carefully at Orange’s proposal.

What place will be really offered to operators buying the activated offer in Brittany?

If the activated offer is too favourable, the small operators will be very active and the big ones (SFR, Bouygues Telecom and Iliad) could be trying to give up themselves to activate the fibre in Brittany. The competition would then be purely commercial and the offers would be very similar.

Will Bouygues Telecom use the Orange LFO link?

Bouygues Telecom is indicated in the decision as to be in the process of subscribing to THD Bretagne’s wholesale passive access offers. In a region where there is no black fibre collection offer other than Orange’s Fibre Optic Link (LFO), Bouygues Telecom would have at least an interest in waiting to know the terms of the activated offer before confirm its commitment to subscribe to the passive access offer.

Will Bouygues Telecom exempt Orange from having to make an activated offer in Brittany?

Bouygues Telecom could theoretically make an active offer to Coriolis, to spread the fixed costs of its regional network of collection. However, if they did, this would open the door to Iliad or SFR. Whereas there have been co-investments in the past between these two actors, it is not sure that such a co-investment is likely to be made today.

Will Orange withdraw its activated wholesale offer if a competitor makes one?

If another actor decided, in a year or two for example, to provide an

activated wholesale offer on the territory of THD Bretagne, what would become the offer that Orange is asked to offer from April 11, 2019? It is not easy to change a passive collection network. Will the links installed in accordance with this offer be maintained? would the offer be frozen at its installed base at the time of the appearance of the competing wholesale offer? The conditions for the changeover involved by ARCEP should be clarified.

How will this decision affect the BEREC guidelines for fibre?

Finally, BEREC, a joint body of European telecoms regulators, is to develop guidelines for fibre regulation and the conditions under which fibre should not be regulated in 2019 and 2020. The extremely subtle case of the latest ARCEP decision will be difficult to explain to other European regulators, who are often in favour of a much more brutal regulation.

________________